Online merchants are constantly faced with terms that go beyond the niche in which they operate. In addition to focusing on marketed products, promotions and dissemination, customer acquisition and retention, merchants still need to deal with bureaucratic, financial and banking issues. As a result, terms such as payment gateway, credit card brand or scheme, PSP and acquirer become part of the online sales universe.

After all, these words are common to every e-commerce business. Since there are different resources and terminologies when it comes to payment methods, it is necessary to learn about each one. So if you would like to know what an acquirer is and what its purpose is, keep reading our article and clear all your questions.

Basic credit card payment flow

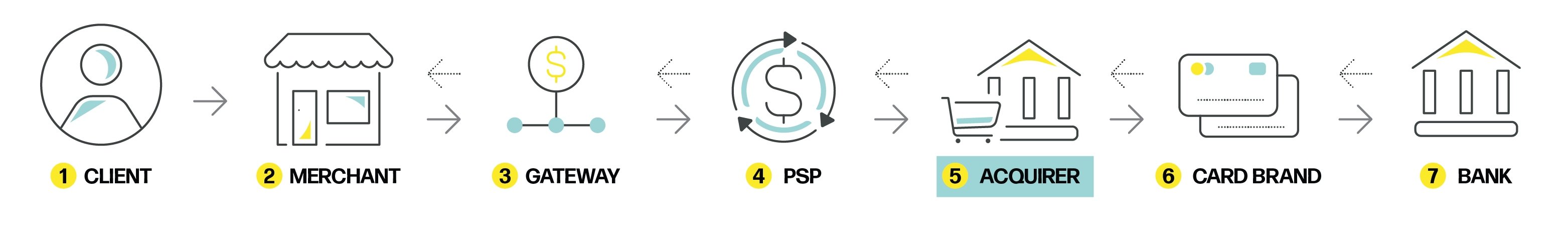

In this article, we’re focusing on the acquirer, a type of company that is an essential partner for stronger, more agile payment strategies. But in order to do that, we must take a step back and explain the credit card payment flow, which you can check out below and see where the acquirer is in the payment process:

As you can notice in the image above, the acquirer is an important part of the payment flow, smoothing the card payment process and ensuring the connection between the online store and the issuing bank.

What is a gateway?

As a critical part of the credit or debit card purchase process, the payment gateway processes the information at the time the purchase is completed. The gateway is the one who communicates information to the acquirer – and in addition to being a communicator and communication bridge between the acquirer and the card brand, it also enables the integration of anti-fraud, acquirer, and conciliator system solutions.

What is an acquirer?

The acquirer is dedicated to solving financial transactions using credit and debit cards. They are responsible for intermediating payments with credit and debit cards, and are key to further optimizing online payments.

An acquirer is a company that processes payments on behalf of another business – by using an acquirer, merchants can offer payment methods and options to their customers. Thus, when a customer buys something from the merchant, they can select how they want to pay. If they choose a credit or debit card, the acquirer receives the payment information, processes it, and communicates the data to the card brand and to the card’s issuing bank.

Merchants need to be connected either directly to an acquirer or to a PSP – also known as sub-acquirer –, which then connects to an acquirer, to be able to receive and process payments paid for with credit or debit cards. Without an acquirer, online merchants won’t be able to accept payments or receive the money from their sales.

There are local acquirers and international acquirers – PagSeguro, for example, is a local acquirer in Brazil, being directly connected to the country’s banking systems and thus processing payments even smoother and more efficiently.

What is the goal of the acquirer?

The goal of the acquirer is to handle payments by connecting the store, the card brand, and the issuing bank – allowing each payment to smoothly flow throughout each step of the way. One of the great advantages of having an acquirer is the activity integration to all those involved, ensuring agility and security in completing operations.

As an acquirer is responsible for debit and credit card purchase process integration, they are also responsible for several processes, such as the registration and payment of purchases, as well as communication with the card brand.

Some of the acquirer's main goals are:

- connect and communicate with all parts of the payment flow (store, gateway, card brand, and issuing bank);

check the card limit;

make the payment to the merchant;

make the card transaction system available to the merchant;

ensure better risk analysis.

Why work with a local acquirer?

If an acquirer is a fundamental partner for online merchants, choosing to work with a local acquirer makes even more of a difference. When the acquiring company is directly present within a market it operates in, it can ensure smoother payment flows, more direct connections to the market’s local payment methods, and more competitive fees – after all, local acquirers are subjected to less cross-border fees than international acquirers.

The more direct connection to the country’s financial system leads to higher approval rates, since local transactions are better “understood” by the issuer bank – the bank knows the merchant and the acquirer –, and is thus more likely to be approved.

What are the advantages of an acquirer?

Accepting credit card payments is of fundamental importance for merchants selling to Latin America, especially to Brazil. This is one of the more common payment methods in the country (64% share of e-commerce) and, in order to reach the entire online consumer base, merchants need to accept domestic-only credit cards —according to our Digital Renaissance in Latin America white paper, they account for 52% of all online purchases.

Therefore, having an acquirer allows the business to enjoy several benefits and reach the full potential of selling to a high-growth market such as Brazil. See some of them below!

Attract more customers

As a large part of the Brazilian consumer market uses credit cards for purchases (especially domestic-only ones, as shown above), providing an efficient acquirer is a good way to attract customers who value diversity and efficiency in payment methods.

Offer greater security

Counting on companies dedicated to intermediating bank transactions made with credit and debit cards is a way to ensure more security in operations. With expert risk analysis, built upon the acquirer company’s extensive payments expertise, you can grow your sales number with security and efficiency.

The acquiring company is a key partner for any merchant and, for that partnership to be successful, choosing an acquirer with up-to-date and reliable security measures is a must. That includes being PCI compliant, a must-have certification that ensures the acquirer is ready to fully ensure the security of your transactions and your customers’ financial data.

Outsource the billing

When the company works with an acquirer, it no longer has to worry about the bureaucracy involved in charging directly to the consumer. This intermediary company will be responsible for this task, and you can receive your sales amount at once, according to your settlement definitions with the acquirer.

Many acquirers also offer the possibility to streamline and facilitate operations involved in cash management. After all, with an acquirer, it is possible to improve your cash management processes.

How do card brands work?

Credit card brands or card schemes are the bodies responsible for regulation, which determine the rules for credit card market operations. Some of these determinations involve the amount of installments that can be made in a purchase, as well as the types of establishments in which different brands are accepted.

The card brand is a regulatory agent for the use of the credit card, acting as a bridge between the acquirer and the consumer's banking institution. Thus, when a purchase is made, it receives information from the acquirer and triggers the issuer, who is responsible for authorizing or not the purchase made.

How do issuing banks work?

The issuing bank is the financial institution that offers credit and debit cards to consumers, being responsible for managing the transactions carried out using its cards. When a payment is made with a card, the issuing bank receives the transaction’s information from the card issuer – who, in turn, receives it from the acquirer.

All being alright, the issuing bank then transfers the amount back to the acquirer, who is responsible for settling the money to the merchant.

What is the role of the PSP?

For a transaction to be carried out, all parties involved — such as acquirers, banks, payment gateways, anti-fraud and reconciliation systems — must be operating correctly. Therefore, hiring each of these solutions, especially for small businesses, can mean excessive work and resources spent.

The PSP – Payment Service Provider – integrates all these features, such as the intermediation of payment means, among all those involved. Its main goal is to pass on the transaction data carried out to the acquirer, as well as to settle receivables with the merchant. It does so in a simplified way, combining the features and benefits of the gateway with those of the subacquirer, in most cases offering a payment processing gateway.

The PSP simplifies and reduces the bureaucracy of using an efficient payment system by connecting with the infrastructure that involves payments, solving the technical problems involved with the flow of information and payments between those involved in the purchase. To use it, merchants don’t need to create an account within the provider or open a local entity to be able to process payments in another country.

However, a PSP’s requirements are not as robust as those of the acquirer. For example, PSP’s are not required to be PCI compliant. If you use a PSP as well as an acquirer, the payment flow looks like this:

Choosing the right payment partner

PagSeguro is a local card acquirer in Brazil, Latin America’s number one market. We are the cross-border division of PagBank (PAGS:NYSE), a solid business that is one of the main fintech companies in the region, ensuring you the reliability and robustness you need to sell to the country. As such, we ensure a payment success rate of at least 98%.

We are also directly connected to local acquirers in other major Latin American markets – Mexico, Colombia, Chile, and Peru –, ensuring you competitive and transparent fees, outstanding approval rates, a fully secure payment operation, and quickness throughout the whole flow.

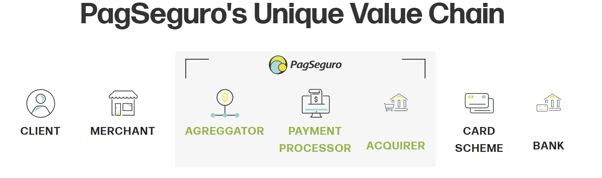

We are essential for your Latam expansion, offering your business a unique value chain:

To succeed in Latin America with the reliability, robustness, and agility your business needs, click below to talk to our expert team and get started now: