Brazil's instant payment Pix has been an unstoppable force from the start – having moved over R$ 14 trillion since launch, it accounts today for over 93% of all transfers in the country. The method has become a phrase – Brazilians will now say “to do a Pix” instead of “to make a transfer” – and a global benchmark for what a RTP (Real-Time Payment) should look like. It’s no wonder, then, that Brazil’s Central Bank is constantly working to expand Pix’s capabilities, and the payment method should receive several new features in 2025 and beyond.

With Contactless Pix already live for a couple of financial institutions and plans to expand to all of them by February 2025, the instant payment could capture an even bigger market share. To understand more about how Pix will change the game – again –, keep reading!

Contacless Pix — “Pix por Aproximação”

Announced by the Central Bank on November 5th, Contactless Pix is currently available only for three financial institutions, but it has already been announced that all institutions that offer Pix will have the Contactless option enabled by February.

In 2023, 82% of all payments in Brazil were made through a smartphone; in that same year, Pix was cemented as the country’s second-most used payment method, only behind cards (including credit, debit, and pre-paid cards): while Pix represented 39% of all payments, 41% were through cards.

Having quickly surpassed traditional bank transfers and boletos soon after it was released, Pix could now surpass even cards, since one of the key reasons why many customers choose to pay with debit cards instead of with Pix is precisely contactless payments: debit cards can be registered to an e-wallet, such as Google Wallet or Apple Wallet, allowing the customer to easily pay with it. On the other hand, Pix requires the financial app to be opened so the customer can input the Pix key or scan the QR Code.

With the option to pay with Contactless Pix, the experience between debit cards and instant payment method becomes virtually the same – with the added advantage of Pix having lesser fees for the merchant, which often leads to discounts for payments with the RTP. Once it’s released widely, Contactless Pix could become the method’s most-used feature until now.

Automatic Pix — “Pix Automático”

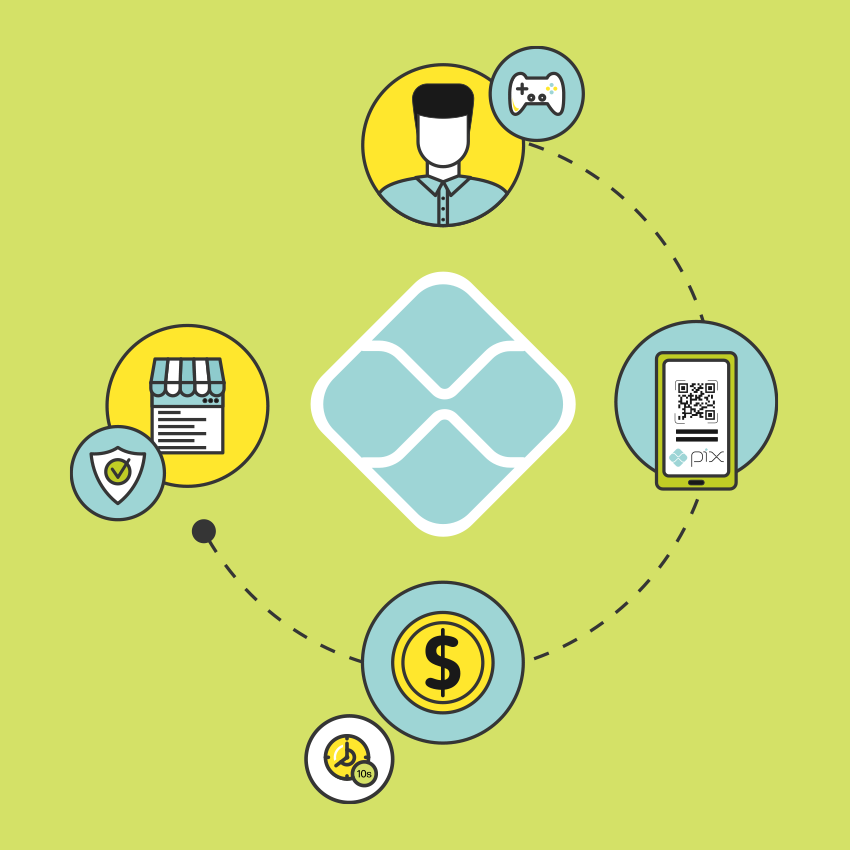

With Pix being a part of the daily lives of Brazilian customers and companies, Pix Automático — or Automatic Pix — emerges as a way to bring the instant payment’s agility and convenience to recurring payments as well. The feature is expected to be released in June 2025, with a few institutions already offering it through internal systems.

With it, users will be able to use Pix to set up recurring payments for services such as Netflix, Spotify, and other types of subscription services. This will facilitate payment for consumers who don’t have credit cards, for example, who right now have to turn to less practical payment methods, such as cash-vouchers and gift cards. Individuals will also be able to use Pix Automático for payments such as electricity and water bills, phone bills, health insurance, and much more.

The feature will be available for P2B payments, that is, made by a natural person to a legal entity, and the recipients will receive payments instantly – unlike when scheduled through automatic debit, which takes one or two business days to clear. Every financial institution registered within the Pix system will have to offer Pix Automático and, as is already the case with regular Pix usage, it will be free of charge for natural persons, but with a fee for legal entities that use it.

Brazil is the second country in the world with the highest rate of streaming service users: 64.58% of the population has at least one streaming service, behind only New Zealand (65.26%), according to research from Finder. The worldwide average is 55.71%. Thus, it’s a market full of potential of increasing Pix’s numbers even further.

Pix Credit for installments

Paying in installments is a common habit for Brazil’s credit card holders: our data shows that up to 50% of e-commerce payments paid with credit cards are made in installments, depending on the merchant.

However, while Brazil has a banking penetration rate of 86%, only 36% of the adult population has a credit card — and, therefore, are able to pay in installments. Pix Credit then comes along to increase access to this payment practice. Most financial institutions already offer this opportunity, including a few options of installments without interest, but it’s not yet regulated by the Central Bank.

Cross-border Pix

We’ve saved the best for last: cross-border Pix is high on the list of features the Central Bank wants to implement. It should still be a few years away, but the idea is to integrate Pix’s system to other instant payment systems around the world.

With Cross-border Pix, Brazilians would be able to send money in Reais to an instant payment key in another country, and the recipient would get it directly in their national currency, and vice-versa. That is, making cross-border transactions would be as easy as making a Pix transfer or payment is today.

It’s a big project that requires innovative technology, regulatory studies, strong security measures, and robust integrations with many different systems, so Brazil’s Central Bank doesn’t expect it to be launched that soon. However, when it does come, Pix could revolutionize cross-border payments as it already did with transactions in Brazil, where the instant payment method quickly became a phenomenon.

After all, this expected feature fits perfectly into the model of Open Finance, where users are free to share their financial data with several different institutions – already quite advanced in Brazil, Open Finance can open up the necessary doors for instant payment systems of different countries to connect, allowing cross-border transfers within seconds.

This could put Pix in an even brighter spotlight around the world. As of now, even though it is only accepted in Brazil, the instant payment method already accounts for 17% of all e-commerce payments in Latin America, having moved almost R$ 406 billion in online sales in 2023.

To make the most of all of Pix’s advantages and all that is to come for the instant payment method, click here to get in touch with us and start offering it to your customers in Brazil!