Introduction

As many international e-commerce merchants will know, incoterms define your relationship with your buyers. In cases of non-domestic purchases, they determine how and where a package will arrive from another country. However, one of the most difficult questions to answer can often be whether to send a package DDP (duty paid) or DDU (duty unpaid). When shipping internationally, there can be any number of complex customs and VAT regulations to understand. Committing to understanding and meeting these duties can be a lot for a business to take on. On the other hand, placing this burden on your customers can leave them less likely to return to your store. We look at the exact definitions of these two terms and identify the positives and the negatives behind each.

DDP and DDU explained

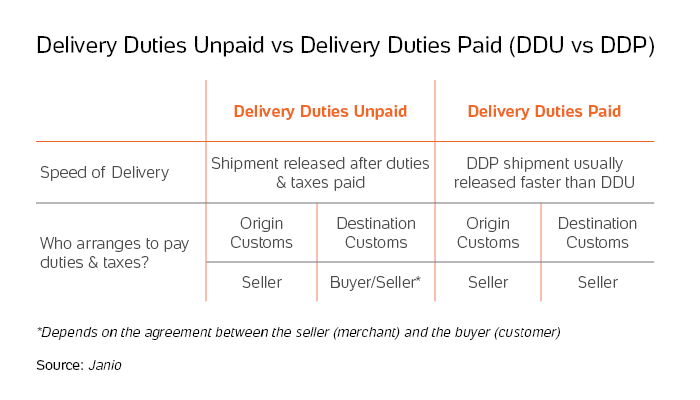

DDP, or Delivery Duty Paid, is when the merchant agrees to pay all customs, duties and fees on a shipment. Generally speaking the shipping carrier you have contracted with will handle most of the customs and duties and bill you the total. However, you remain responsible for ensuring that you are meeting all requirements.

DDU stands for Delivery Duty Unpaid. In this scenario, an international e-commerce merchant takes responsibility for the shipment until its arrival in the destination country. Depending on the country’s customs legislation, the buyer is responsible for customs clearance. Often the buyer will be contacted by a customs authority and required to pay these duties before receiving their shipment.

The case for DDU

On the face of it, it seems natural for international e-commerce merchants to favor DDU. Latin America has a vast array of different customs procedures and duty requirements. While in countries like Australia, duties don’t kick in until the value of the item is above 1,000 USD, in Brazil the minimum value is 50 USD for DDU entry. It can lead to businesses being bogged down in complex paperwork and often requires consultation either from a shipping company or lawyer to determine what the customs requirements are.

However, while understanding your obligations may be difficult, there are strong reasons to do so. First and foremost, DDU is likely to force your customers to negotiate customs and duties themselves. This is not ideal and vastly reduces your competitiveness against domestic companies. Worse yet, DDU items are often forwarded to independent customers brokers. Each of these businesses has their own costs and payment schemes and many take advantage of charging extra fees for storage or late payment. In turn, this leads to high abandonment rates for shipments. Clearly, this will be a quite a shock to any customer. The knock-on effect is a reduction in repeat business, which as we have noted in previous articles, can cost your business up to seven times as much.

Making DDP easier

But international businesses looking to work in Latin American markets do have a number of tools at their disposal to aid the DDP process. DPP does entail greater up-front costs for international businesses. But international shipping companies are doing their best to smooth this process and share the costs, while also offering tools to help you calculate your customs duties in advance of shipping.

Secondly, remember that your international shipping company can help. DDP can often cost more up front than DDU, but keep in mind that DDU comes with many hidden fees later on. Many international couriers will take fees up front to pay duties on your behalf and smooth the customs process out. This means faster delivery for your customers, and no hassle to receive their goods. Additionally, DDP results in a lower shipment abandonment rates and lower shipment latency. This leads to happier customers, less likely to turn to your competitors. Remember that some DDP costs can be offset in the price of the item itself. In doing so, your business does not lose revenue and your customers have a more streamlined purchase process.

What works for your business?

In all of these scenarios, the most important thing to consider is to follow what works best for your own business. E-commerce merchants interested in expanding to LATAM will have to face many decisions like this one, involving local taxes, regulations, bureaucracy, localization, among many others.

Consulting with a local specialist like BoaCompra can help you navigate these complexities, making this process as low impact as possible and allowing your business to grow. Talk to us now and learn more:

.jpg)